Rhode Island offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

RI Renewable Energy Portfolio

RI Clean Energy Incentives

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Rhode Island Government

82 Smith St.

Providence, RI 02903

(401) 831-8099

[email protected]

Hours: M-F 8:00am – 5:00pm

Rhode Island Energy

P.O. Box 371361

Pittsburgh, PA

1-855-743-1101

Hours: M-F 7:00am – 7:00pm

State of Rhode Island Office of Energy Resources

One Capitol Hill

Providence, RI 02908

(401) 574-9117

[email protected]

Hours: M-F 8:00am – 5:00pm

National Weather Service

1325 East West Highway

Silver Spring, MD 20910

(501) 834-0308

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| Solar Sales Tax Exemption< | Sales tax exemption | Applies to solar equipment |

| Solar Property Tax Exemption | Upgraded property value tax is exempt | Applies to residential property using solar energy |

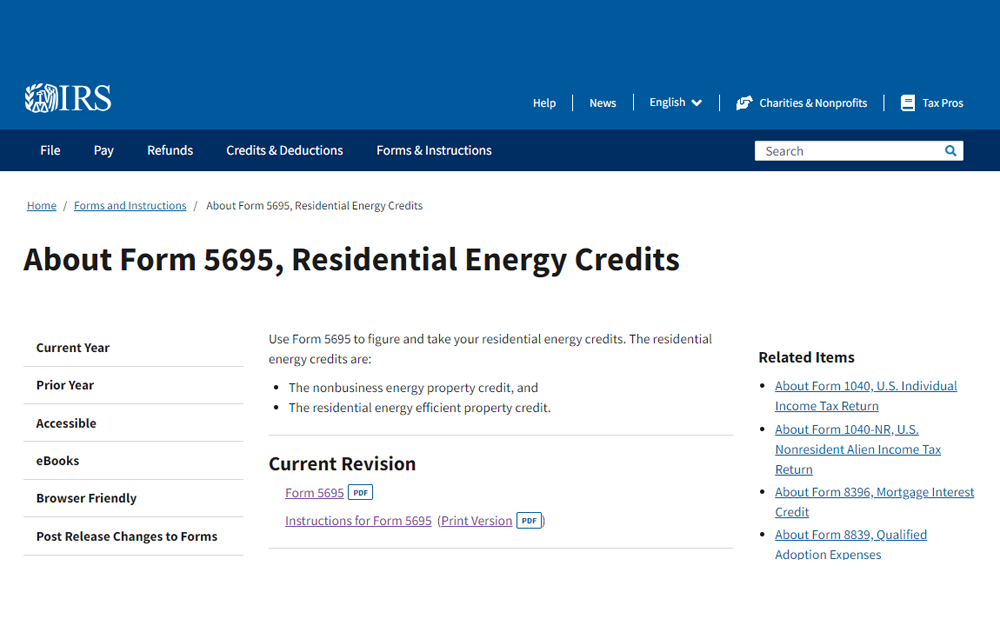

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Rhode Island Clean Energy

Solar

Wind

Hydro

Biomass

Energy Storage

Energy Resilience

Clean Transportation

Clean Energy Jobs

Department of Environmental Management

235 Promenade Street

Providence, RI 02908

Hours:

8:30am-4:00pm

Phone: 401-222-4700

Mailing Address:

RI DEM

235 Promenade Street

Providence, RI 02908

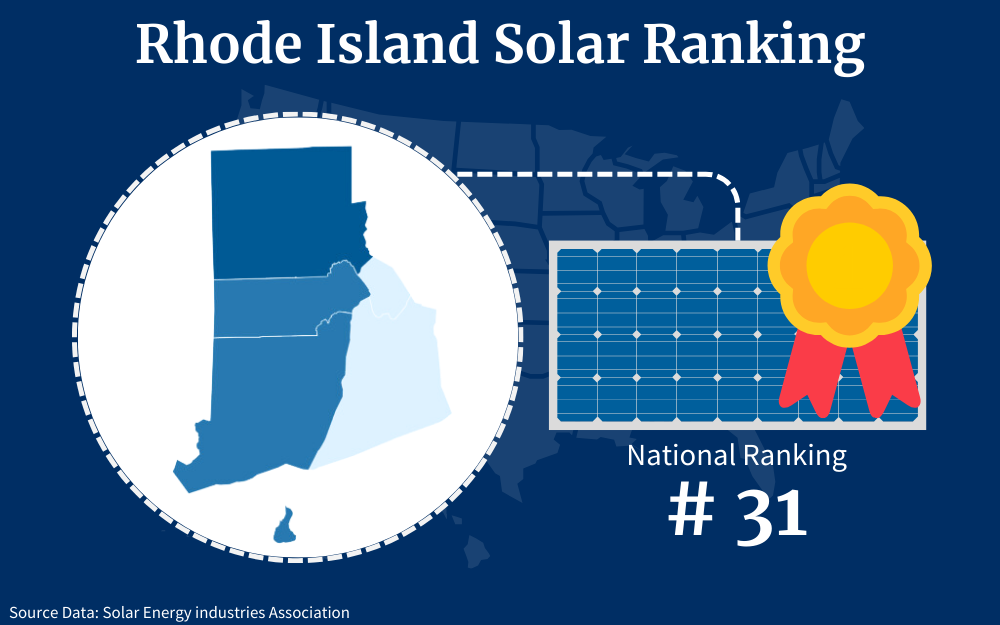

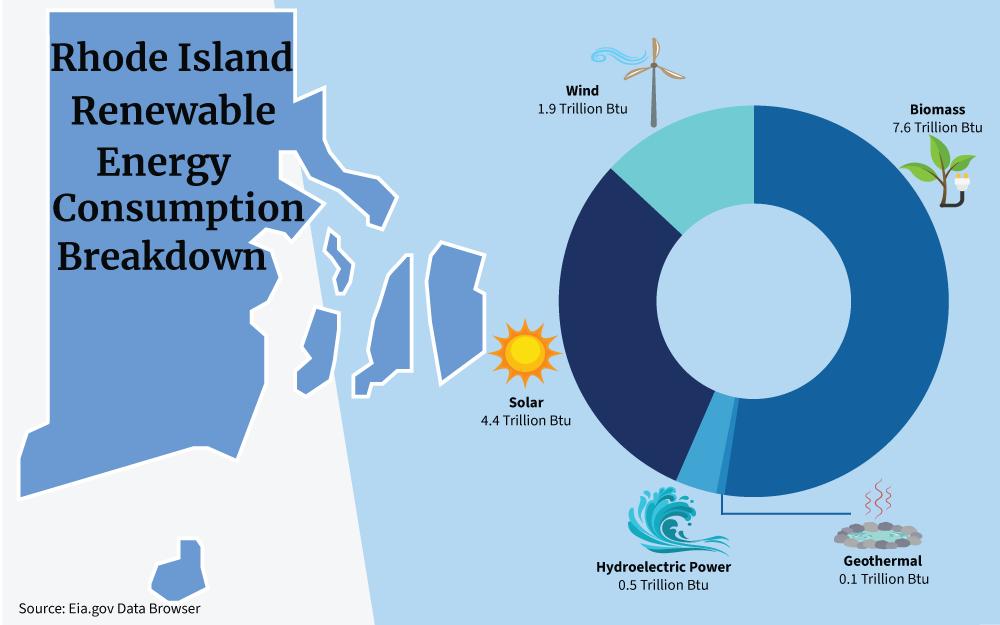

Rhode Island Energy Overview

As a resident, you’re probably very familiar with the notoriously high electricity rates in the state: 11th highest in the country.1 The cost of electricity in Rhode Island (per kilowatt-hour) is more than 21% above the national average.

It’s no wonder that so many homeowners are eager to break free from expensive utility bills by enrolling in renewable energy programs that offer rebates, credits, and discounts for green energy.

And with the recently passed Affordable Solar Access Pathways initiative, even low-income households can now tap into solar savings. Additionally, with its ambitious goals of 100% renewable energy reliance by 2033,10 the Ocean State is poised to continue growing its solar capacity.

So, which Rhode Island solar incentives can make switching to solar easier for you? From federal tax credits, state rebates, net metering, and other state-level incentives, this guide will show you how Rhode Island is smoothing the way for residents like you to switch to solar and how to use the available incentives.

Solar Panel Tax Credits in Rhode Island

No doubt, the federal Investment Tax Credit (ITC) is the most valuable solar incentive available to you as a Rhode Island resident. This program can slash 30% right off the cost of installing a solar energy system on your home.

Intrigued? Here’s how it works and how you can claim it.

Overview of the Federal ITC

First authorized in 2006 and recently renewed in 2022, the federal ITC offers the biggest financial incentive for solar nationwide,15 hands down. As a Rhode Island homeowner, the ITC allows you to reduce your federal income tax bill by 30% of the total purchase and installation costs of your new, self-owned solar system installed on your primary or secondary residence.

To qualify for the full 30% tax credit, you must own the solar system rather than leasing or signing a solar PPA.

The home must also be your primary or secondary residence. Rental properties do not qualify.

The solar system must be installed and operational between January 1, 2022, and December 31, 2032.

Additionally, all equipment must also be new. Solar panels used before or repurposed modules will not be accepted into the program.

For example, if you pay $15,000 to go solar, you’ll owe the IRS $4,500 less next tax season. That’s a direct dollar-for-dollar savings off what you’d normally pay Uncle Sam.

The ITC was recently extended to 2034, providing over a decade more of solar savings for you.

How To Claim the Federal Solar Tax Credit

Claiming the ITC credit is fairly straightforward. As you file your taxes for the year in which your solar system goes live and becomes operational, complete IRS Form 5695 and submit it along with your regular tax return paperwork.3

You will also need to provide your installer’s contact information as well as documentation showing your installation costs. This includes receipts and invoices for equipment purchases, installation labor, permitting costs, and any other expenses related to the installation.

Supposing the credit amount is more than your tax liability for the current year, you can roll over the remaining credit to your future tax returns for up to 5 years until you can claim the full value of the credit.

EERE Programs Explained: Residential Solar Tax Credits

In addition to the federal ITC, Rhode Island also offers several state-level programs that together can drastically reduce your out-of-pocket expenses when going solar. These incentives fall under the state’s Renewable Energy Fund (REF) and are overseen by the Office of Energy Resources and Commerce RI.

Rhode Island Renewable Energy Fund (REF) Small-Scale Solar Program

The RI REF is run by the Rhode Island Commerce Corporation and issues grants to homeowners like you who install small-scale solar photovoltaic systems on their primary residence.7 The grant is paid directly to your chosen solar installation company, who then discounts that amount from your total system cost.

This upfront rebate lowers the amount you have to pay out of pocket. Note that to qualify for this grant, your solar system needs to be Net-Metered.

The grant is based on a rate of $0.65 per watt of your solar system’s capacity, and capped to a maximum of $5,000. There is also a $2,000 add-on grant available if you add energy storage like home solar batteries to your system.

Here’s how the REF Grant works:5

- Your installer applies for the grant on your behalf before starting the installation

- REF reviews the application and issues an Award Letter if approved

- Your installer then signs a Grant Agreement which legally allocates the funds to your project

- After installation, REF inspects the system and then releases the grant money to your installer

- Your installer then reduces the total cost of your installation by the amount of the grant.

This process can sometimes be tedious and time-consuming.

As such, be sure to get written confirmation of the grant approval and discount amount before signing your final contract. Do not rush into signing the agreement.

Also, note that this is a popular program with a limited amount of annual funding. This also means that the REF application windows are short.

Therefore, act quickly once you receive a notification to maximize your solar savings. The next Small-Scale PV Grant Application is slated for October 13th, 2023.7

Rhode Island Renewable Energy Growth (REG) Program

The RI REG program is administered by Rhode Island Energy and offers an alluring alternative to net metering.13 This program pays you for the excess renewable electricity generated by your rooftop solar panels for home at a fixed, premium rate for 15 to 20 years.

Provided you are an RI Energy customer, this program enables you to sell your solar generation output under long-term tariffs at fixed prices. You will need to sign a contract committing you to the program for 15-20 years.

Once in the program, you will accumulate bill credits up to your full electric usage amount. Any additional generation will then earn you direct payments.

For small home solar systems, REG pays around 26 to 28 cents per kilowatt-hour generated which is much higher than net metering rates.

To enroll, your installer must submit an application to Rhode Island Energy through their website during the short April window each year starting on April 1st.

If accepted, you will automatically start collecting REG payments based on your solar energy production. Monitor your bills to ensure proper crediting and cash payments.

However, note that you cannot combine REG with REF grants although you can still combine either program with the ITC. Therefore, compare the long-term earnings against the upfront savings when choosing between REF and REG.

Note that this decision is binding for the lifetime of the contract.

Affordable Solar Access Pathways (ASAP)

In 2023, Rhode Island launched the Affordable Solar Access Pathways (ASAP) program to provide solar access to low-income households.6 This program allows qualifying applicants to go solar at no upfront cost through a solar lease or PPA.

How does it work?

A solar company purchases and installs a solar system on your home if you live in an underserved area at no deposit or expense to the homeowner. In exchange, your installer enjoys a higher federal tax credit incentive.

Once the system is installed, you can then benefit from net metering to reduce your electric bills. All paperwork and smart meter installation are handled by the solar company and REF.

To be eligible for this program, you must be from a low-income household and be located in designated regions known as environmental justice areas. Rhode Island categorizes a low-income household as one where the median income is $44,512 for a property with two residents or $65,460 for a couple with two children.

Sales Tax Exemption

Looking to go solar in Rhode Island? Here is a Rhode Island solar incentive that requires no application whatsoever from you.

The state offers a 100% sales tax exemption on all equipment related to installing solar systems.4 This includes solar panels, inverters, racking, home battery systems, wiring, as well as the labor for the installation.

This tax exemption is applied automatically at the point of sale.

At the current sales tax rate in Rhode Island, you will save around $1,190 on the average $17,000 solar system cost. Solar incentives don’t get any easier than that.

Property Tax Exemption

Rhode Island also offers you a property tax exemption when you switch to solar power.9 Typically, home improvements like installing solar panels raise your property value and thus your property taxes.

However, solar installations are excluded from assessed property value increases in Rhode Island.

As such, even though adding solar will increase your home value by over $15,000, a national average of 4.1%, you will not need to pay a cent more in property taxes for this increase. This saves you hundreds of dollars every year over your system’s lifetime.

And the best part is you don’t need to lift a finger to claim it; the exemption applies automatically when your solar installation is complete.

Community Solar

Is it possible to benefit from solar if you don’t have a solar system in your home?

In Rhode Island, yes, it is possible. If your roof is not suitable for a solar installation or you rent your home, community solar allows you to access renewable energy savings.11

How does this work? You will need to subscribe to a portion of a larger, shared solar array site (also known as a solar farm) located away from your home but connected to the grid.

Rhode Island’s virtual net metering (VNEM) program then credits your utility account for your portion of the system’s generation,12 even though it’s not physically on your property.

This off-site model makes solar easily accessible for residents lacking adequate roof space or capital for their own system. While it is not possible to get solar panels for free in RI, this is the closest thing to it.

Connected Solutions

You can get paid for not using electricity. Through Rhode Island Energy, Connected Solutions will allow you to get paid for limiting your energy use when grid demand peaks.8

You get paid for allowing remote control of your home battery system to feed electricity to the grid and thus reduce strain on the grid during key hours.

As a Net-metered customer and/or a REG program participant, you can enroll in Connected Solutions and earn additional bill credits. All you need to do is install an approved battery and inverter system that can be controlled by your utility company when needed.

The program can also provide you with a zero-interest HEAT loan of up to $25,000, for you to install a battery storage system in your home.

Will this cause you to go without power? No. Under the current program rules, your battery will only be ‘called’ to provide to the national grid during the summer, from June to September, from 2 to 7 p.m., and no more than 3 hours each time.

How Can I Apply for Solar Tax Credits in Rhode Island?

Capturing the maximum value from Rhode Island solar incentives takes a little preparation and paperwork on your part.

- Gather Your Information: Collect all relevant documents, receipts, and information related to the energy-efficient improvements made to your home.

- Download IRS Form 5695: Visit the official IRS website to download the most current version of Form 5695.

- Complete IRS Form 5695: Fill out the federal IRS Form 5695 following the instructions provided in the form itself.2 This includes listing the energy-efficient improvements you made, their costs, and any associated tax credits.

- File Your Federal Tax Return: Attach the completed Form 5695 to your federal tax return (e.g., Form 1040) and submit it to the IRS.

- Keep Records: Retain copies of all documents and receipts for your records in case of an audit.

Below are the sources of tax credits in Rhode Island:

- Federal Solar ITC: File IRS Form 5695 when you do your taxes for the year your solar system becomes operational. Be ready with your installer’s information and documentation showing your system costs including all receipts, and invoices.

- REF Grant: Your solar company handles the application process for this rebate. Be sure to confirm the approved discount amount is applied to the final prices of your system. Additionally, be on the lookout when the application window opens.

- REG Payments: Your installer must submit your application during the April enrollment window. Ensure the grant is approved before signing your solar contract.

- Sales Tax Exemption: This is automatically applied at the point of sale on your solar equipment purchases.

- Property Tax Exemption: No application is needed. Your home will simply be excluded from additional tax assessments.

Home Solar Installation Expenses and Materials

As it stands, over 11% of the state’s energy comes from solar,16 enough to power just over 120,280 homes.

If you’re considering installing solar panels on your Rhode Island home, it’s important to understand the key equipment and associated costs:

Solar Panels

Solar panels are made up of photovoltaic cells (PV cells) that absorb photons or light particles from sunlight to convert them into electricity.

The solar panels or PV modules themselves account for about 40% of total system costs. You’ll likely choose between monocrystalline or polycrystalline silicon panels rated around 300 watts each.

How long will solar panels last?

It depends on their build, quality as well as maintenance. Proper panel management as you use it is important in ensuring the longevity of your system.

But ideally, the lifespan of the sun panels or solar panels you’ll purchase should be between 25 to 30 years.

If your question is, “How much do solar panels cost exactly”; it depends. Expect to pay around $2 to $4 per watt capacity of your system depending on the type, specs, and brand.

For a typical 6 kW home solar system, your PV panel cost will range from $12,000 to $24,000.

Inverter

You also need an inverter to convert the DC electricity from the panels into usable AC current for your home. Microinverters on each panel optimize energy harvest but cost more than central string inverters.

Plan on spending approximately $0.20 to $0.40 per Watt. As such, for a 6 kW residential solar system, your inverter will run between $1,200 and $2,400.

Batteries

Adding home energy storage batteries can allow you to store solar energy for use at night or as part of the Connected Solutions program. Plan on spending around $8,000 to 12,000 for an average battery system sized to your home’s solar capacity and energy needs.

Mounting Equipment

Properly mounting your solar panels is important. Racking costs range from $1 to $3 per watt depending on your roof’s shape, pitch, and layout.

Most homes spend around $1,000t to $2,000 for mounts and hardware for a typical 6 kW system.

Monitoring System

While optional, a monitoring system lets you track energy production, lifetime savings, and system performance. Basic monitoring starts around $500, while advanced panel-level monitoring can cost up to $1,500 plus data fees.

Wiring

Electrical wires and conduits connect all the solar components into one smoothly functioning renewable energy system. While small, these necessary supplies add $1,000 to $2,000 to the total expense.

Permits and Labor

Remember to budget for permit fees to comply with Rhode Island building codes as well as HOA guidelines. Labor will account for 10 to 25% of your total solar panel cost.

Solar Calculator: How Much Can You Save?

Figuring out your potential solar savings starts with using an accurate online solar calculator tailored to Rhode Island’s conditions.

There are different calculators on the internet that can compute numbers related to solar energy for you, like a solar farm profit calculator, for instance. What you’ll need specifically, however, is a solar savings calculator.

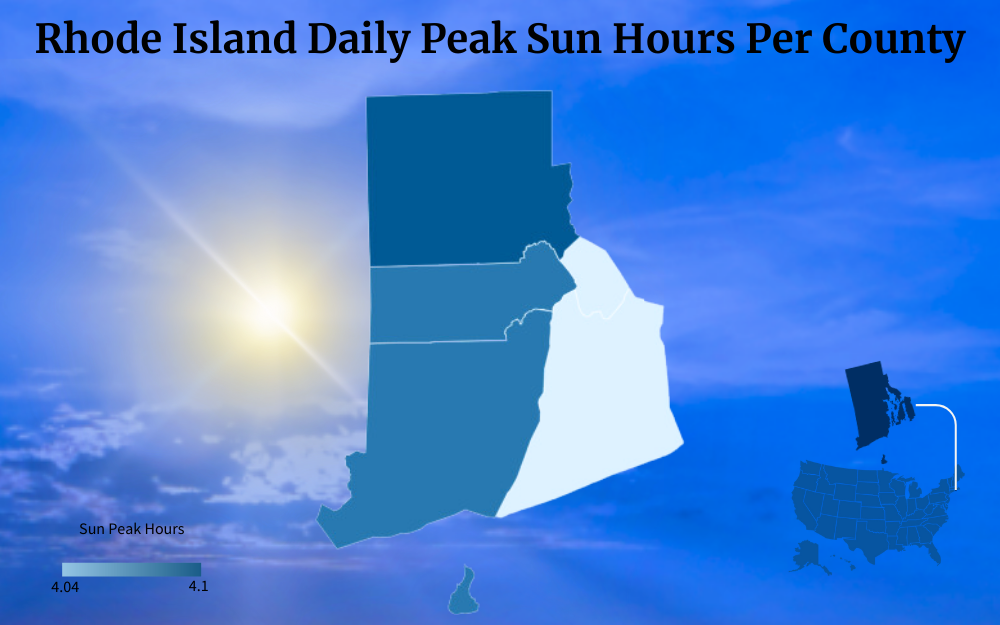

A quality calculator will ask for your address (to figure out your location’s peak sun hour), utility provider, average electric bill, and details about your roof. It will then estimate the ideal system size for your household along with projected energy output and monthly savings.

A good solar calculator will also provide you with the total estimated system cost based on average Rhode Island solar pricing. From this amount, you can then subtract incentives like the 30% federal tax credit and the rest to reveal your final out-of-pocket expense.

This gives you a clear picture of the full investment as well as the long-term electricity bill savings you could realize by switching to solar.

Can I Sell Power Back to the Grid?

Once your solar panels in Rhode Island are up and running, any excess electricity they produce can be sold back to the grid through net metering or power purchase agreements (PPAs) available in Rhode Island. This provides additional savings on top of shrinking your own electric bills.

Net Metering

Net metering, or simply NEM, is a regulation that allows power to flow back and forth through connections between a smart meter in your home and the electric grid. This agreement ‘pays’ you for the excess electricity that is generated by your solar panels and transferred to the grid.

This occurs when your panels absorb more sunlight than your household needs and convert it into surplus energy. Instead of storing that extra energy in expensive batteries, RI Energy gives you credits for your excess energy which you can later use when you need to draw energy from the grid.

Your smart meter tracks these solar credits flowing into the plus and minus columns.

The credits roll over from month to month and are capped at 125% of your annual usage. When you reach 100% solar power, your bills drop dramatically.

Your solar installer will do the paperwork to enroll you in net metering.

Rhode Island’s virtual NEM even allows credits for off-site community solar, making solar easily accessible despite space limitations. Overall, net metering provides superb flexibility to maximize solar savings.

However, note that you can either choose to have a net-metered system or a REG system, but not both. Therefore, choose the one that gives you the most benefits.

Power Purchasing Agreements (PPAs)

A power purchase agreement (PPA) allows you to switch to solar without the steep upfront cost associated with a new solar installation.14

A solar company handles everything from design, purchase, installation, and management of the system. All you have to do is agree to purchase the power generated by the system.

Under this arrangement, the solar company owns the solar system which also means that they own the power including any excess power generated. That said, PPAs offer a great solution to people looking to switch to solar with no upfront costs.

Where To Buy Solar Panels in Rhode Island?

Although switching to solar has many benefits, you need to make sure that you purchase good solar panels and choose a good installer in order to realize all the benefits.

Sure, you can google “how to make solar cells’’ and go the DIY route if you feel like you have enough knowledge, but getting it professionally done is still the best way since this is a huge investment.

Here is how to go about choosing the right solar installer:

- Ask around or search online for “solar supplies near me” so that you’ll have a list of local manufacturers and installers who are experts in solar energy around your area.

- Check online reviews and talk to neighbors for recommendations. Credible referrals are invaluable.

- Confirm proper licensing, training, certifications, and insurance coverage with prospective installers. This guarantees expertise.

- Compare multiple quotes for your specific needs and home. Seek great value, not just low prices.

- Ask about equipment brands, warranties, ratings, and performance expectations. Quality matters.

- Favor local firms when possible for better service and building code familiarity.

- Thoroughly review all contract terms and ask questions before signing. A reputable company will provide you with full transparency.

- Don’t fall for free solar panel scams like ‘free solar panels for seniors’ targeting the elderly. The long-term payoff justifies the investment.

Solar Power as Green Energy

Wondering how does solar panel help the environment? Are solar panels toxic?

There wouldn’t be a global push for the adoption of solar energy if it’s not beneficial for the planet. By not emitting harmful gases into the atmosphere unlike common energy sources like coal, solar power can help mitigate global warming and thus, climate change.

However, since the technology still uses materials and metals that are considered hazardous, solar panel waste in landfills could still be a problem in the future if they’re not disposed of properly.

So, when your system reaches its end-of-life, be sure to go through the necessary steps to have it fittingly discarded or recycled.

With tax credits, rebates, and incentive programs, Rhode Island is fully committed to making solar power for house or any residential property affordable and accessible for residents across the state.

By tapping into all available Rhode Island solar incentives, you can maximize savings and quickly pay off a new solar system installation; after which you can enjoy decades of free renewable power and energy bill savings as you also help Rhode Island hit its bold renewable energy targets.

Frequently Asked Questions About Rhode Island Solar Incentives

Does Rhode Island Offer a State Tax Credit for Solar Panels?

No. There is currently no Rhode Island state income tax credit or deduction available. However, the federal tax credit generally covers most homeowners’ income tax liability anyway.

How Much Do Solar Panels Increase Home Value in Rhode Island?

On average, adding solar panels boosts a Rhode Island home’s resale value by about 4%, or over $15,000 for a typical 6 kW system. This premium helps recoup your solar investment faster.

Are SRECs Available in Rhode Island?

Unfortunately, Rhode Island does not currently have an active solar renewable energy certificate (SREC) market. Net metering and utility performance incentives provide higher savings here.

References

1Electricity Local. (2023). Rhode Island Electricity Rates & Consumption. Electricity Local. Retrieved September 15, 2023, from <https://www.electricitylocal.com/states/rhode-island/>

2Internal Revenue Service. (2022). Residential Energy Credits. IRS. Retrieved September 15, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

3Internal Revenue Service. (2023, February 17). About Form 5695, Residential Energy Credits. IRS. Retrieved September 15, 2023, from <https://www.irs.gov/forms-pubs/about-form-5695>

4N.C. State University. (2022, December 8). Renewable Energy Products Sales and Use Tax Exemption. DSIRE. Retrieved September 15, 2023, from <https://programs.dsireusa.org/system/program/detail/1237>

5Rhode Island Commerce Corporation. (2021, November 15). Small-Scale Program Application. Rhode Island Commerce. Retrieved September 15, 2023, from <https://commerceri.com/wp-content/uploads/2021/11/Small-scale-Solar-DIRECT-Application-11.15.21.pdf>

6Rhode Island Commerce Corporation. (2023). Affordable Solar Access Pathways. Rhode Island Commerce. Retrieved September 15, 2023, from <https://commerceri.com/wp-content/uploads/2022/12/RFP-REF-Solar-Vendor-for-Affordable-Solar-Access-Pathways.pdf>

7Rhode Island Commerce Corporation. (2023). Renewable Energy Fund. Rhode Island Commerce. Retrieved September 15, 2023, from <https://commerceri.com/financing/renewable-energy-fund/>

8Rhode Island Energy. (2023). ConnectedSolutions. Rhode Island Energy. Retrieved September 15, 2023, from <https://www.rienergy.com/RI-Home/ConnectedSolutions/>

9State of Rhode Island. (2022). Property Subject to Taxation. State of Rhode Island General Assembly. Retrieved September 15, 2023, from <http://webserver.rilin.state.ri.us/Statutes/TITLE44/44-3/44-3-3.HTM>

10State of Rhode Island. (2022, June 29). Governor McKee Signs Historic Legislation Requiring 100% of Rhode Island’s Electricity to be Offset by Renewable Energy by 2033. Office of the Governor. Retrieved September 15, 2023, from <https://governor.ri.gov/press-releases/governor-mckee-signs-historic-legislation-requiring-100-rhode-islands-electricity-be>

11State of Rhode Island. (2023). Community Solar. RI Office of Energy Resources. Retrieved September 15, 2023, from <https://energy.ri.gov/renewable-energy/solar/community-solar>

12State of Rhode Island. (2023). Net Metering And Virtual Net Metering Overview. RI Office of Energy Resources. Retrieved September 15, 2023, from <https://energy.ri.gov/renewable-energy/wind/net-metering>

13State of Rhode Island. (2023). Renewable Energy Growth Program (REG Program). RI Office of Energy Resources. Retrieved September 15, 2023, from <https://energy.ri.gov/renewable-energy/wind/renewable-energy-growth-program-reg-program>

14U.S. Department of Energy. (2023). Power Purchase Agreement. Better Buildings. Retrieved September 15, 2023, from <https://betterbuildingssolutioncenter.energy.gov/financing-navigator/option/power-purchase-agreement>

15U.S. Department of Energy. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Energy.gov. Retrieved September 15, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

16U.S. Energy Information Administration. (2023). Rhode Island State Profile and Energy Estimates. EIA. Retrieved September 15, 2023, from <https://www.eia.gov/state/analysis.php?sid=RI>

17Photo by the State of Rhode Island. RI.gov. Retrieved from <https://energy.ri.gov/renewable-energy/ris-clean-energy-portfolio>

18Photo by the State of Rhode Island. RI.gov. Retrieved from <https://dem.ri.gov/environmental-protection-bureau/land-revitalization-and-sustainable-materials-management/solar-ri-closed-landfills>